‘The Most Life-Destroying Word of All is ‘Tomorrow’’: Rich Dad Poor Dad Author Robert Kiyosaki’s Critical Financial Advice

In a powerful reminder about the hidden costs of procrastination, renowned financial educator and best-selling author Robert Kiyosaki once asserted, “The most life-destroying word of all is ‘tomorrow.’” With this stark warning, Kiyosaki emphasizes the profound danger of delaying critical decisions, particularly in the realm of personal finance. According to Kiyosaki, waiting to invest, address debt, or otherwise confront financial challenges can significantly damage an individual's economic future, turning minor issues into insurmountable obstacles.

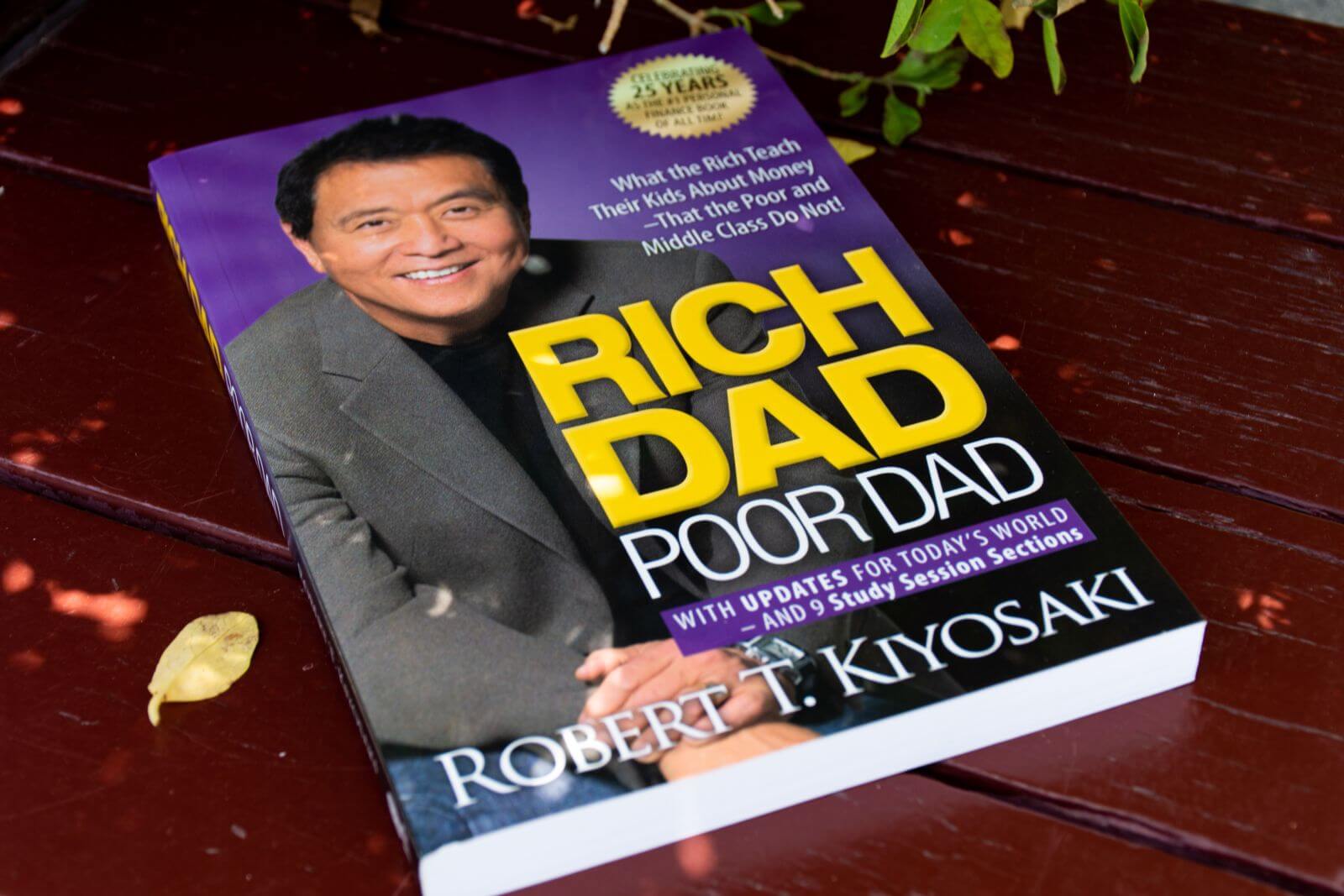

This powerful statement encapsulates a core principle of Kiyosaki’s widely influential financial philosophy. Known internationally for his groundbreaking book, Rich Dad Poor Dad, Kiyosaki has spent decades advocating for financial literacy, empowerment, and immediate action. His teachings consistently highlight that delaying investments or financial education can lead to lost opportunities, which compound over time into substantial losses. Thus, the word "tomorrow," he argues, often serves as a deceptive comfort that provides short-term relief at the expense of long-term prosperity.

Kiyosaki’s caution against procrastination aligns closely with his advocacy for financial education as the foundation of personal success. He frequently underscores that building wealth and security requires active engagement rather than passive avoidance. In this context, his critique of postponement is not simply an abstract philosophical point; it is a pragmatic warning that resonates deeply in today’s rapidly shifting economic environment.

Don’t Miss:

- Think it’s too late to invest in the booming AI sector? This one’s still under the radar

- How This Startup is Disrupting the $4.83 Trillion Wealth Engine That’s Been Hidden From Everyday Investors for Over 93 Years

In recent times, this advice has become even more critical amid significant economic volatility. Throughout 2024 and 2025, fluctuating interest rates, rising inflation, and market unpredictability have placed unprecedented strain on households worldwide. Individuals who heeded Kiyosaki’s counsel, proactively addressing their financial situations by managing debt, creating emergency savings, or strategically investing, have generally weathered these storms more successfully than those who deferred action. Conversely, those who relied on "tomorrow" to solve financial problems now find themselves in significantly worse conditions — deeper in debt and farther from financial independence.

Critics might argue that impulsiveness also carries its own risks. However, Kiyosaki counters that taking informed action today — based on education and sound financial principles — is fundamentally different from reckless impulsiveness. He advocates measured urgency grounded in a robust understanding of personal finance. This distinction is key to understanding his emphasis on action: the cost of hesitation, he argues, far outweighs the potential cost of thoughtful, immediate engagement.

Ultimately, Kiyosaki’s message speaks to broader themes of personal responsibility and accountability. His assertion about the destructive power of procrastination encourages individuals to confront their finances directly and proactively, promoting a lifestyle of intentionality rather than avoidance. As economic conditions continue to evolve, Kiyosaki’s timeless insight remains a critical reminder: the word “tomorrow” often represents a subtle yet profound danger, capable of quietly undermining one’s financial future.

On the date of publication, Caleb Naysmith did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.