Is Intercontinental Exchange Stock Outperforming the Dow?

/Intercontinental%20Exchange%20Inc%20logo%20purple%20background-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Valued at a market cap of $102.9 billion, Intercontinental Exchange, Inc. (ICE) provides technology and data to financial institutions, corporations, and government entities. The Atlanta, Georgia-based company operates a network of global futures, equity, and options exchanges, including the New York Stock Exchange (NYSE).

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and ICE fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the financial data & stock exchanges industry. The company's combination of technological innovation, regulatory trust, and global operational scale enables it to serve as a critical infrastructure provider for financial markets, while continuously expanding into adjacent high-growth verticals like sustainable finance and digital assets. Its core strengths lie in its diverse market infrastructure, robust data services, and strategic innovation across asset classes.

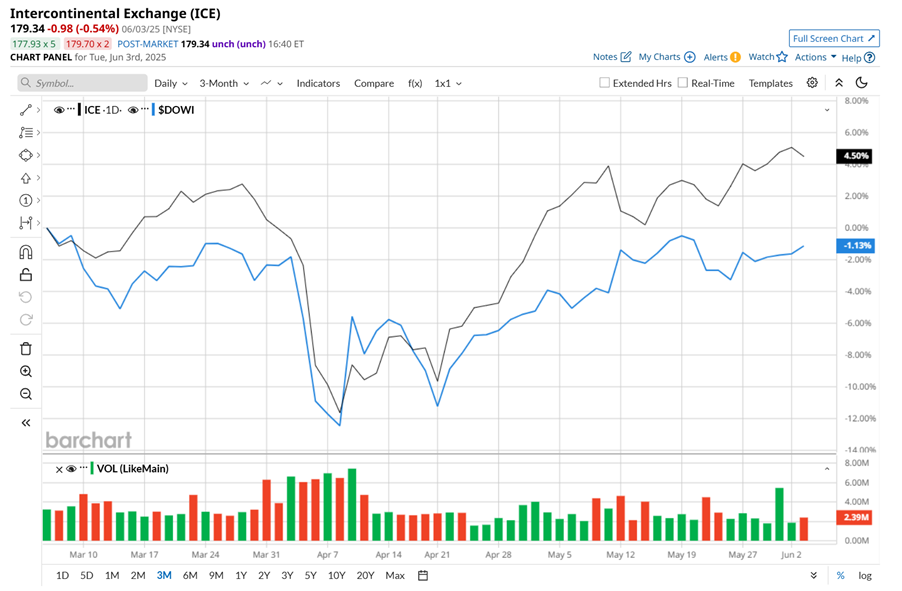

This financial services giant touched its 52-week high of $180.89 in the last trading session. Moreover, ICE has gained 3.6% over the past three months, outpacing the Dow Jones Industrial Average’s ($DOWI) 1.6% downtick during the same time frame.

In the longer term, ICE has rallied 34.2% over the past 52 weeks, outperforming DOWI’s 10.2% uptick over the same time frame. Moreover, on a YTD basis, shares of ICE are up 20.4%, compared to DOWI’s slight loss.

To confirm its bullish trend, ICE has been trading above its 200-day moving average over the past year, with minor fluctuations, and has remained above its 50-day moving average since late April.

On May 1, shares of ICE surged 1.7% after its impressive Q1 earnings release. Both its net revenue of $2.5 billion and adjusted EPS of $1.72 came in above the consensus estimates. Moreover, its net revenue improved 8% from the year-ago quarter to a record high, driven by strong performance across all segments, with the exchange segment leading the way with a notable 22.4% increase in revenue. Additionally, a 200 basis-point expansion in its adjusted operating margin contributed to a 16.2% year-over-year growth in its adjusted EPS.

ICE has lagged behind its rival, CME Group Inc. (CME), which gained 39.9% over the past 52 weeks and 21.6% on a YTD basis.

Looking at ICE’s recent outperformance relative to the Dow, analysts remain highly optimistic about its prospects. The stock has a consensus rating of "Strong Buy” from the 18 analysts covering it, and the mean price target of $194.41 suggests an 8.4% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.