With a 5.6% Yield, This Dividend Aristocrat Pays Monthly. Is It a Buy Here?

Dividend stocks are a go-to option for investors seeking a steady income stream. While many companies pay dividends, Dividend Aristocrats are dependable names that allow investors to generate worry-free income.

These companies are known for their financial strength, robust cash flow, and focus on rewarding shareholders. Typically, they are large, well-established businesses that have proven their resilience through various economic cycles. Their ability to maintain and grow dividend payments, even in tough times, makes them especially appealing to investors seeking stability and steady income.

Among the Dividend Aristocrats, Realty Income (O) stands out for its high yield of 5.6%. Moreover, it is known as “The Monthly Dividend Company,” paying and growing its payouts month after month.

Realty Income: The Monthly Dividend Powerhouse

Realty Income owns a diversified portfolio of more than 15,600 commercial properties. The real estate investment trust (REIT) has strategically spread its investments across various tenant types, property categories, and geographic regions. This broad diversification enhances the firm’s resilience and supports consistent cash flow generation, enabling reliable dividend payments.

Approximately 65% of the company’s holdings comprise U.S. retail properties. These properties are occupied by high-quality tenants with a proven track record of financial stability throughout economic cycles. The vast majority, approximately 98%, of Realty Income’s portfolio consists of single-tenant properties, most of which operate under triple-net lease agreements. These leases are particularly advantageous for the REIT because they provide predictable, long-term rental income while keeping operating costs low. Under this structure, tenants handle most property-related expenses, which helps protect Realty Income’s profit margins and support its ability to continue paying attractive dividends.

This focus on long-term leases and cost-efficient property management has helped Realty Income build an enviable track record of dividend payments and growth. Since going public, the company has declared 660 consecutive monthly dividends and has been included in the S&P 500 Dividend Aristocrats Index.

Today, Realty Income offers a monthly dividend of $0.2690 per share, amounting to an annualized payout of $3.23. With a dividend yield of approximately 5.6%, the REIT is an attractive option for investors seeking stability and consistent monthly income.

A Steady Dividend Machine Built for the Long Haul

Realty Income has a solid history of dividend growth, and the REIT is likely to maintain this streak through its high-quality assets and steady growth. Its focus on prime real estate locations and high-quality tenants enhances the firm’s ability to re-lease or dispose of assets as needed.

Its conservative underwriting standards and strict investment criteria provide further protection against credit risk. An impressive 99.6% of the portfolio has seen no credit losses, reflecting the strength and stability of its tenants.

Notably, the REIT remains committed to a tenant mix rooted in recession-resistant sectors, such as grocery stores and wholesale clubs. Realty Income benefits from industries that perform well even during economic downturns. More than 90% of its retail rent comes from tenants that provide nondiscretionary goods or essential services, critical buffers in uncertain times. Additionally, over a third of its tenants are investment-grade.

Realty Income ended Q1 with a high occupancy rate of 98.5% and a rent recapture rate of 103.9% across 194 leases, with the vast majority of those leases being renewals from existing clients.

Realty Income is also expanding its global reach, particularly in Europe, where it sees compelling opportunities. This geographic diversification helps mitigate country-specific risks while opening up new avenues for income generation.

Looking ahead to the rest of 2025, Realty Income is well-positioned to deliver steady growth. Its large scale, solid financials, and diversified footprint across asset classes and geographies will enable it to pay and increase its monthly dividends in the future.

The Bottom Line

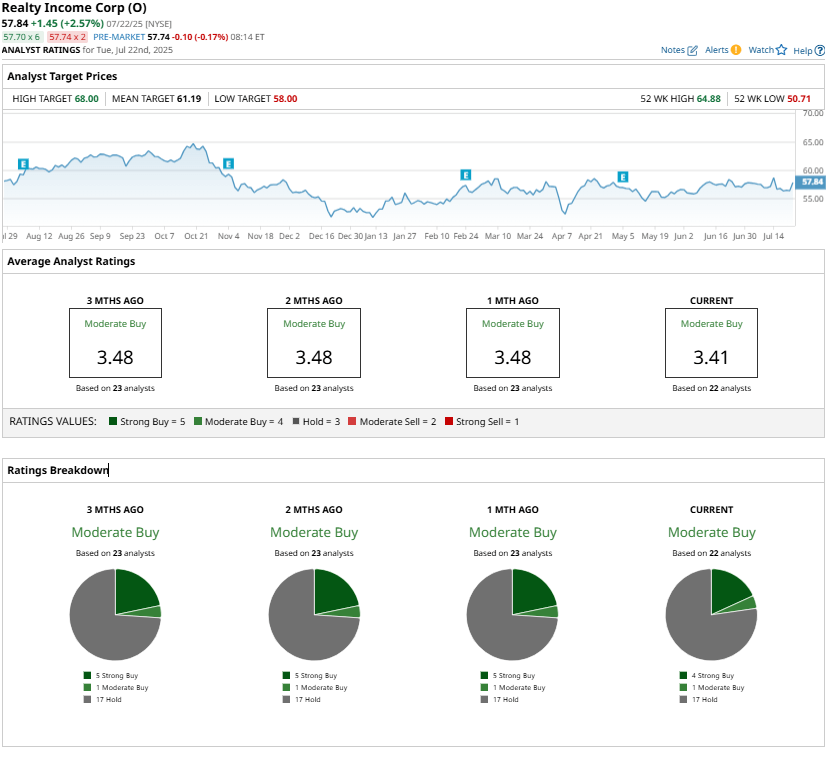

Realty Income has a “Moderate Buy” consensus rating, implying it is not the highest-rated stock. However, this REIT is a go-to for investors who prioritize steady passive income. Its consistent monthly dividend payments, ability to increase its future payouts, and a high yield make it a compelling investment to start a growing income stream for years.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.