After a Rally of Biblical Proportions, Are Gold and Gold Miner ETFs Losing Their Shine?

Gold (GCZ25) doesn’t need an introduction. It has been around for much longer than the stock market. The New York Stock Exchange, exchange-traded funds (ETFs), and the futures pit were not part of the Bible. Gold was.

Gold is one of those investments that, when it is soaring as it is now, even people who do not follow the markets closely tend to know it is doing well. That could be because they are shopping for gold jewelry, or perhaps because they ran into one of the many TV commercials touting gold.

But here, we’ll stick to the public markets, and particularly a trio of ETFs I find helpful to assess the prospects for gold.

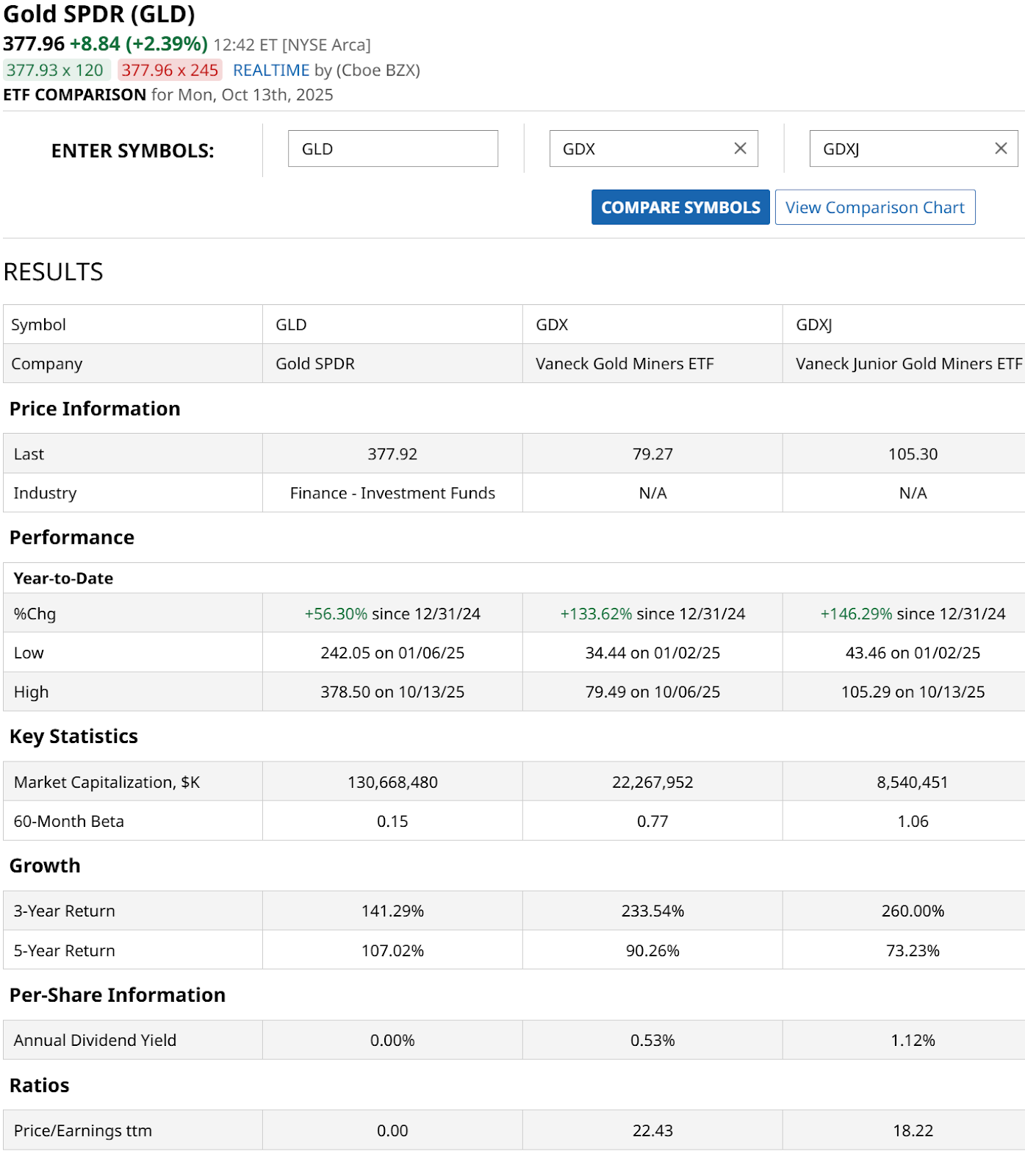

Currently, gold is on a historic run higher, as depicted by the parabolic move in the SPDR Gold ETF (GLD). For comparison purposes, in the table below I’ve also included the Van Eck Gold Miners ETF (GDX), which owns gold stocks instead of the commodity, and that same firm’s ETF devoted to smaller gold miners, the “juniors,” through a separate ETF (GDXJ).

This table shows us that all three gold ETFs are popular. GDXJ, the smallest of them, has more than $8.5 billion in assets under management. We also see that those smaller mining companies tend to be more volatile than the larger ones, based on the 1.06 beta for GDXJ to GDX’s 0.77.

Past returns hint that this additional risk has not translated into that much more reward over some time frames. The shortcut analysis to me: GDXJ outperformed GDX over the past 3 years, but not over the past 5, in which the total return was lower. Gold and gold stocks slumped during the first two years of that 5-year period, and GDXJ’s return suffered more than that of GDX or GLD.

This all sets the stage for my main question here.

With this remarkable move in gold and in GLD, are the mining stocks worth the additional risk? And, if GLD continues its epic rally, will GDX and GDXJ continue to outperform? Since I can’t predict the future, but I can handicap the field like a horse race, let’s go to the charts and try to pick a winner.

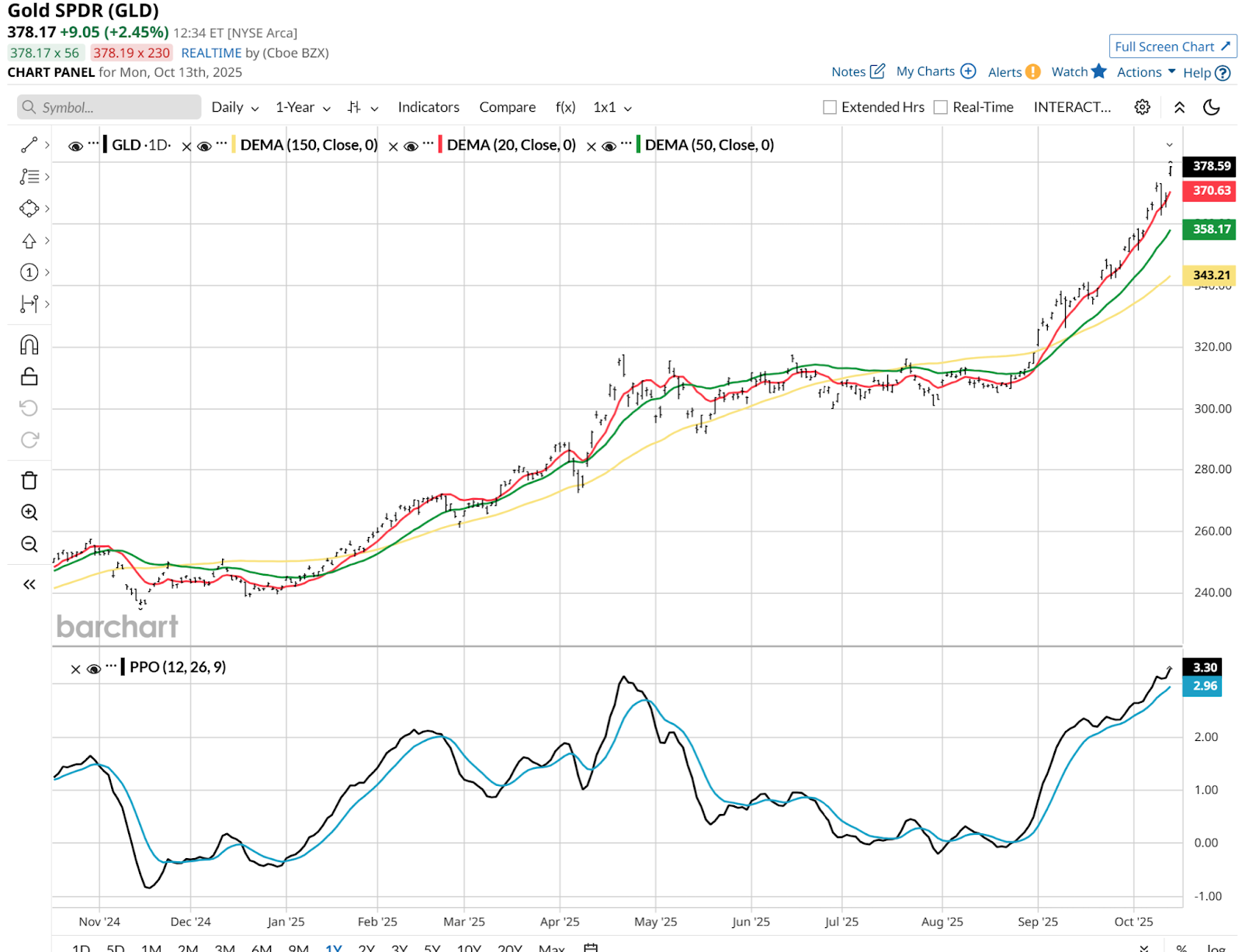

GLD Is Up 56% This Year, But Can It Continue?

Gold’s uneven performance over time is not as evident in this chart, which shows as close to a straight up move as you’ll see. It’s as if GLD flew out of a cannon on Labor Day. And while its Percentage Price Oscillator (PPO) indicator at the bottom of the chart looks very pricey, it has not yet rolled over.

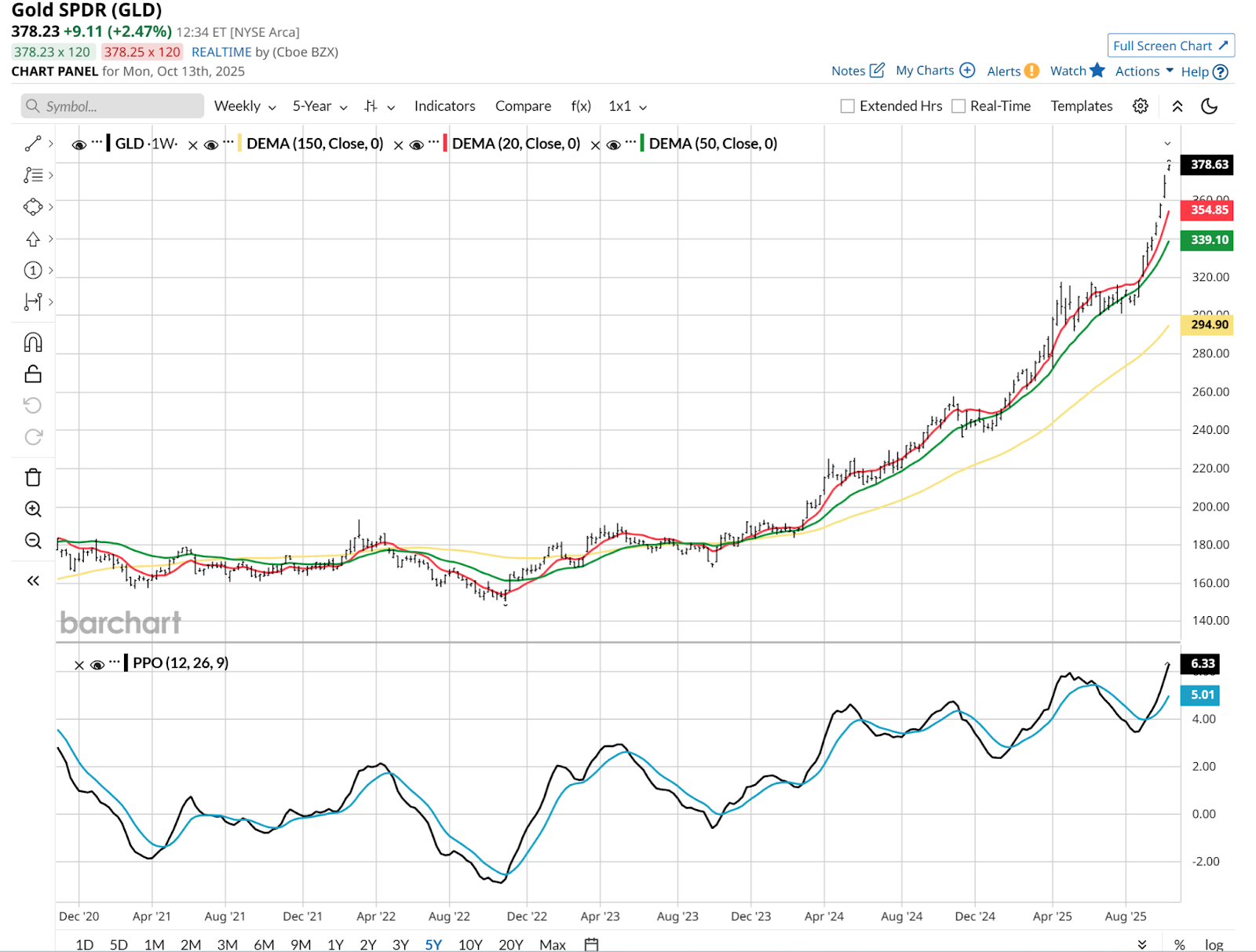

This weekly chart of GLD has the same type of look, just extending out to show the huge 18-month rally in full. The PPO is also unusually “well-behaved” in that it is not even cycling, just making higher highs and higher lows.

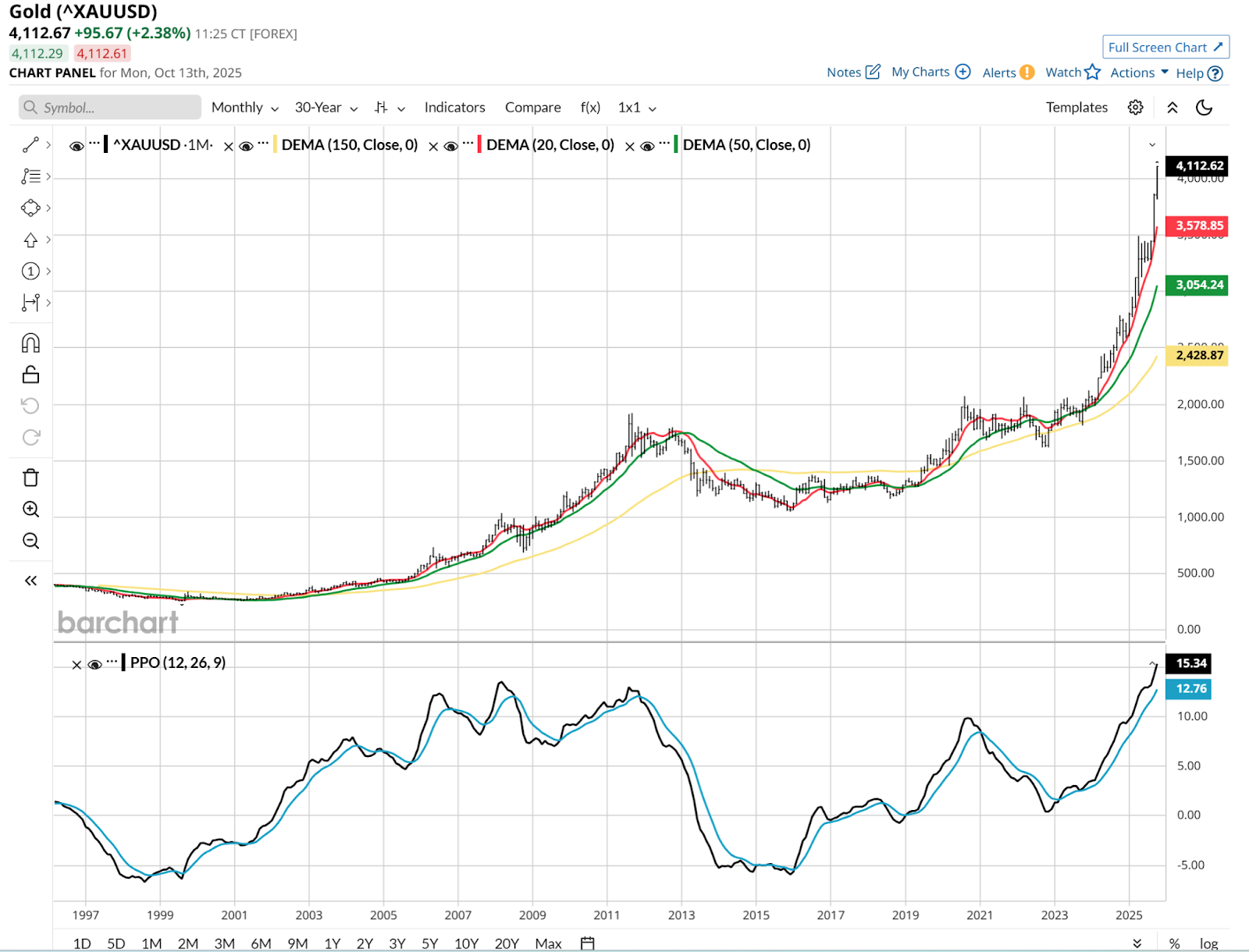

But this monthly chart, back to 1995 before there was a gold ETF, shows the “yellow metal” currently in rarified air. Or, if you prefer, uncharted territory. It also shows that gold, which does not pay a dividend like a stock might, has gone 10 years or more without producing a positive return. When we consider that gold is an inflation-fighter, that’s not great.

Gold Mining ETFs Don’t Always Move Like Gold ETFs

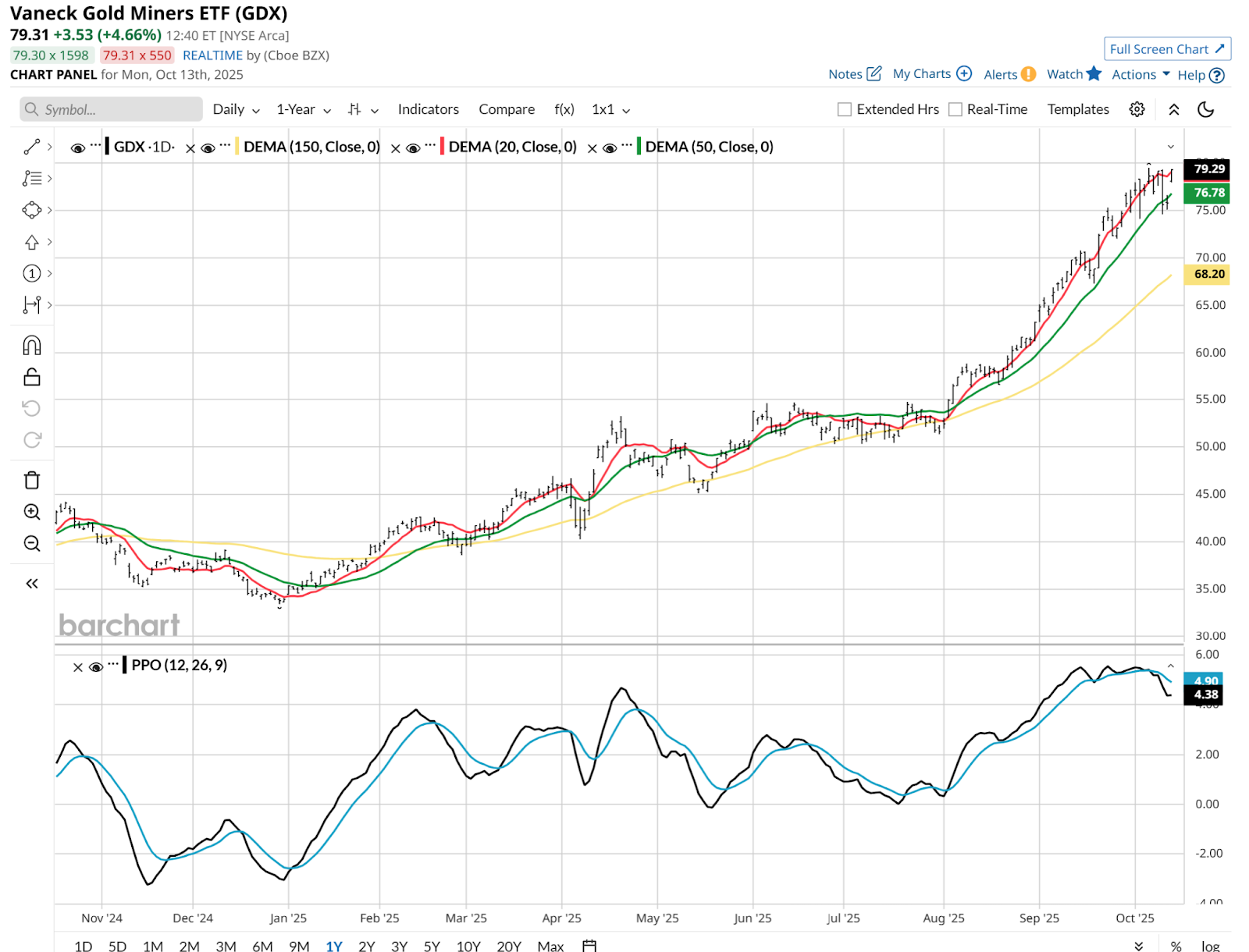

What about the mining ETFs? GDX is shown below, and I instantly see something to point out. That price and PPO are already showing signs of peaking.

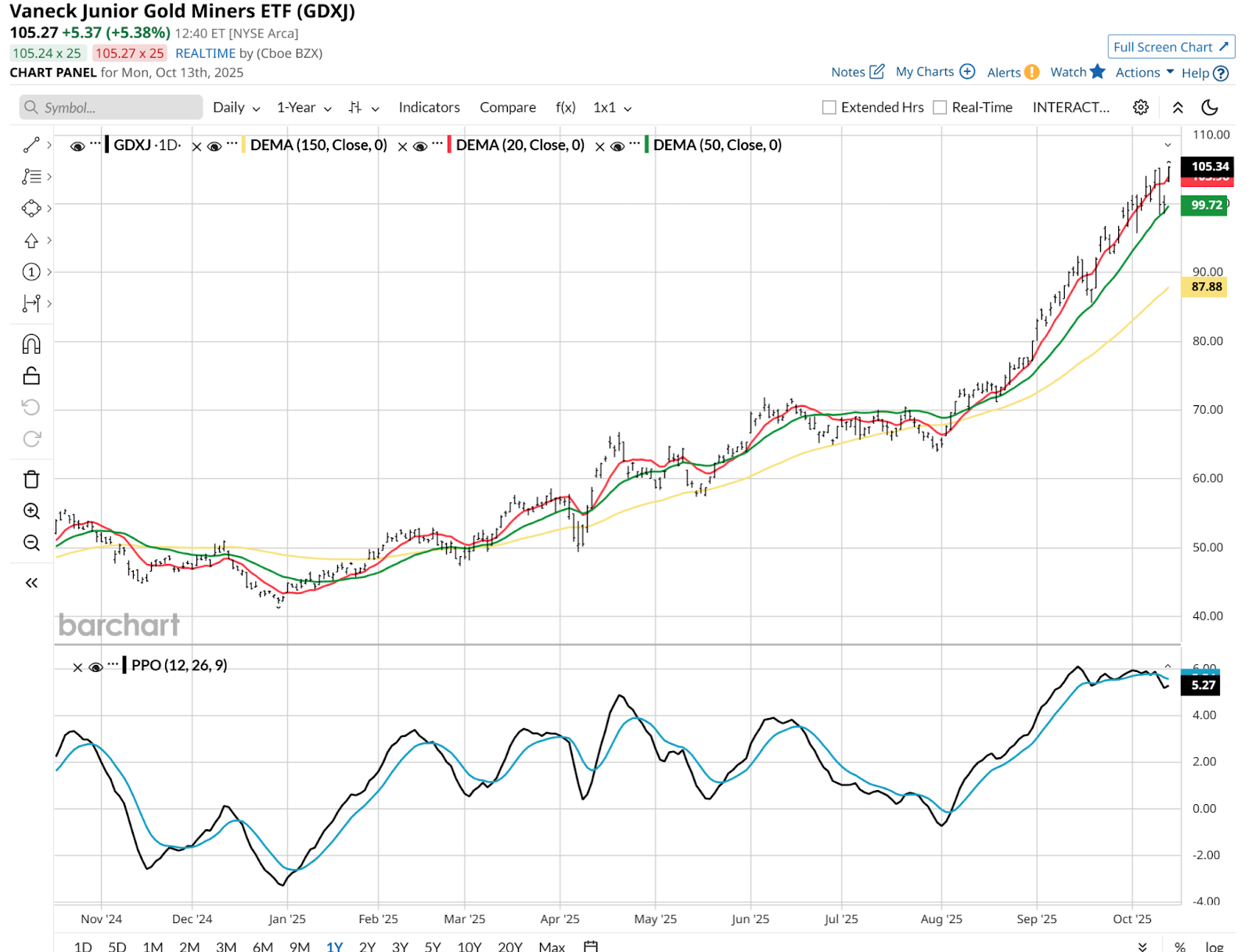

GDXJ has the same look to me. Translation: Gold stocks look more likely to give in first, while GLD might have a bit more staying power.

There’s a very good reason for this, and it is frankly why I tend to use gold much more than gold miners in my ETF trading. My take is that gold is a very unique asset. And while it is far from my favorite to trade, who can pass up an opportunity to trade that commodity like it’s a meme stock? Not me. Especially since it is easy to hedge.

But those miners are not as simple as “gold plays” in an equity ETF. They are also stocks. And sometimes, as with oil stocks, they are treated as stocks by the market. So yes, there are times when GDX and GDXJ can lead gold higher. But when the moves get as outsized as these, I don’t like the risk that comes with additional potential reward. And I’m all about risk management.

How I’m Milking Gold

So for me, my gold positions are smaller and shorter-term these days. I may not be the first one to say it this way, but just in case: I traded GLD for a while, and I still do, but I’m “milking” gold now. Smaller positions, more likely through call options than an ETF like GLD, to really cap my loss potential after a manic run this year.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.