Should You Buy, Sell, or Hold Tilray Stock After Q1 Earnings?

There has been a resurgence of strong cannabis stock performance over the last few months due to renewed hope that the U.S. will reschedule cannabis and better company fundamentals. Investors have not wasted time rewarding firms that project actual improvement, and Tilray Brands (TLRY) is set to be a big winner.

Tilray announced strong Q1 earnings on Thursday, Oct. 9, and sparked frenzy throughout the cannabis industry. The management underscored profitable expansion in all three divisions (cannabis, beverages, and wellness), and its shares shot up sharply following the announcement. Tilray is proving to be one of the more stable companies within an otherwise unstable market, owing to its growing international sales and cost controls.

Let’s take a closer look to see whether Tilray’s strong earnings signal it’s time to rethink your portfolio strategy.

About Tilray Stock

Based in Canada, Tilray is a global lifestyle consumer products company engaged in research, cultivation, processing, and distribution of medical cannabis products. The company’s product portfolio includes medical and adult-use cannabis, pharmaceutical and wellness products, beverages, and hemp-based food products.

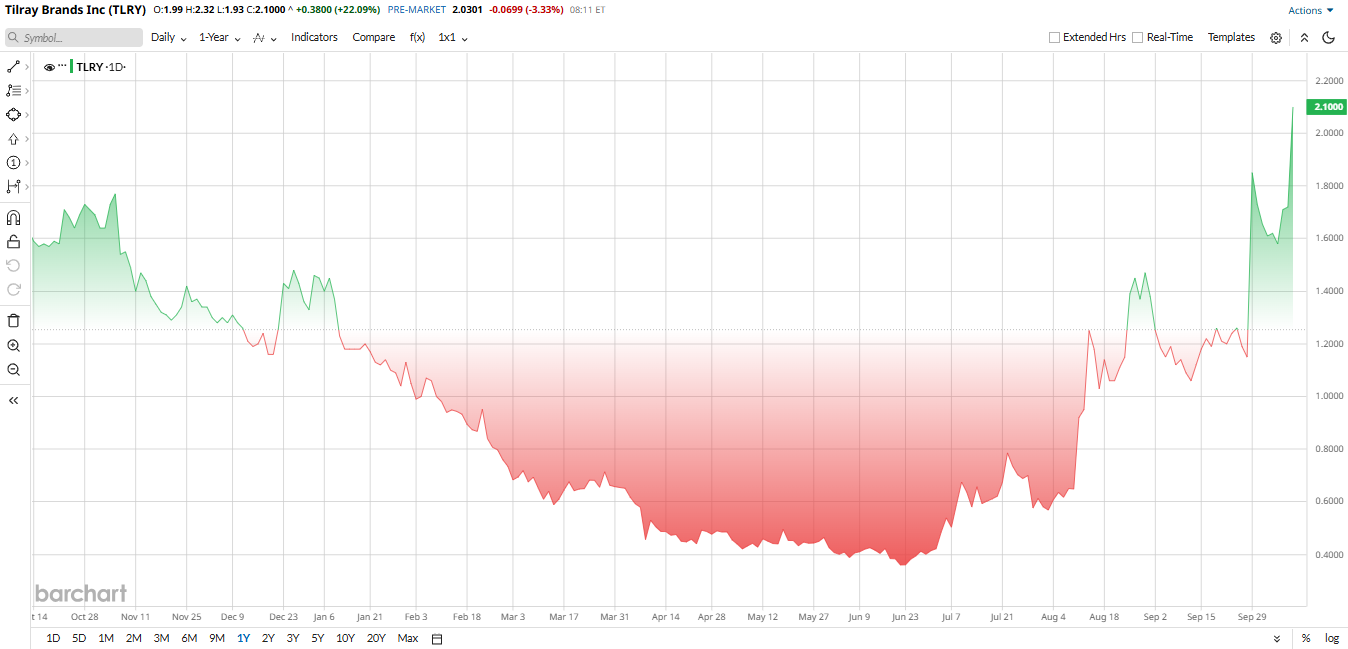

Tilray’s stock has been extremely volatile this year. Early in 2025, TLRY was trading around $0.60 to $0.70, but it then rallied strongly to trade currently in the $1.70 range. Shares are up 29% in the year to date and an impressive 240% over the past six months.

Despite trading as a penny stock, Tilray has a premium valuation through several traditional measures. The cannabis and beverage company now commands a market capitalization of about $2 billion, supported by annual revenue of just over $820 million in 2024.

For instance, its adjusted forward price-to-earnings ratio of 53x remains elevated compared to the sector median of 17.5x, reflecting investor expectations for stronger profitability and growth ahead.

Tilray Beats Q1 Earnings Estimate

Tilray Brands reported a strong start to fiscal 2026, posting record first-quarter net revenue of $209.5 million, up about 5% year-over-year, driven by healthier cannabis and distribution channels. Gross profit for the quarter was $57.5 million, and consolidated gross margin came in at 27%, slightly below last year’s 30%. Tilray returned to profitability in Q1 with net income of $1.5 million, a swing from a $34.7 million loss a year earlier, and adjusted EBITDA rose 9% to $10.2 million.

By business line, cannabis net revenue climbed to $64.5 million, a 5% jump YoY. Beverage sales held near $55.7 million, distribution rose to $74 million, and wellness reached $15.2 million, all helping offset softer pricing in some markets.

Cash flow also improved. Cash used in operations narrowed to $1.3 million, a year-over-year improvement of $34 million. Tilray ended the quarter with $264.8 million in cash and marketable securities while trimming net debt to roughly $4 million. Free-cash-flow dynamics improved but remain a focus as the company balances reinvestment and margin recovery.

Management reiterated fiscal-year 2026 guidance for adjusted EBITDA of $62 million to $72 million but did not provide a specific consolidated revenue or EPS target for the quarter.

What Do Analysts Say About TLRY Stock?

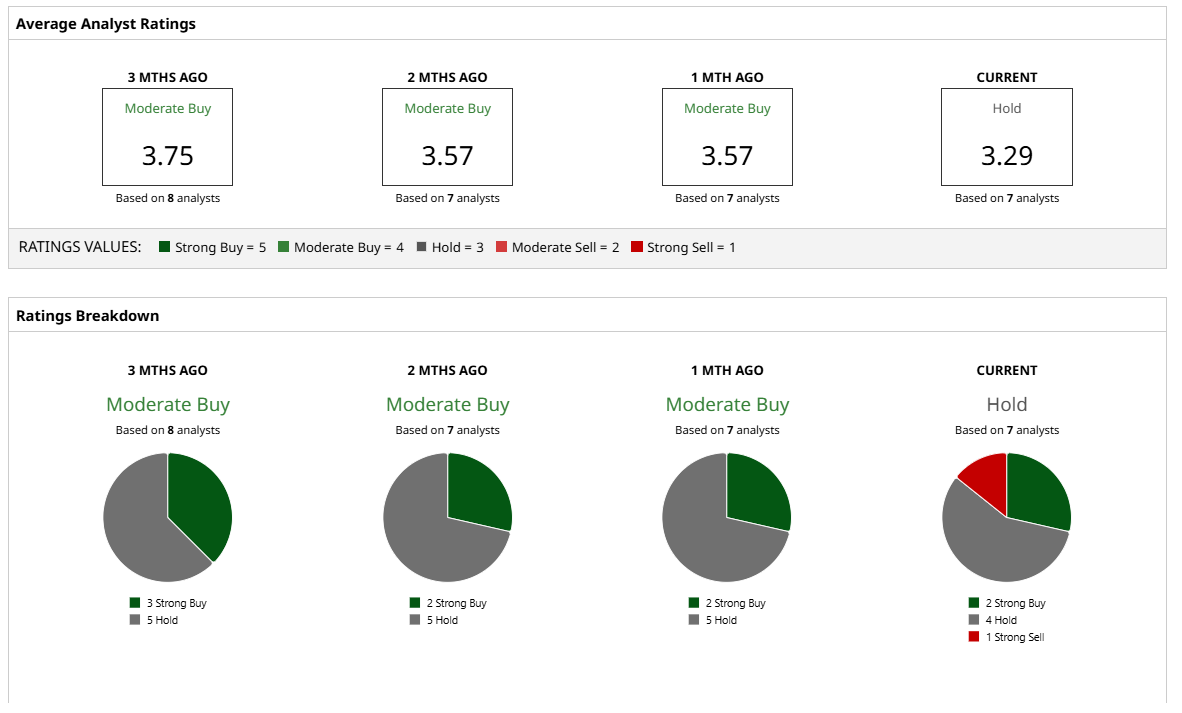

Analyst sentiment is mixed but largely cautious. Jefferies’ Kaumil Gajrawala has been one of the more optimistic voices, maintaining a “Buy” and arguing that Tilray’s brands and scale could benefit from favorable policy moves.

Overall, Tilray carries a “Hold” consensus rating, with two analysts calling it a “Strong Buy,” four assigning a “Hold” and one issuing a “Strong Sell.” The stock currently trades above its mean price target of $1.12, indicating potential downside of 33%.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.